how long does the irs have to collect back payroll taxes

An extension of time to file will also automatically process when taxpayers pay all or part of their taxes electronically by this years original due date of April 18 2022. This is called the 10 Year Statute of Limitations.

Http Ntcfinancialhowlongcantheirscollect Livesites Biz 2013 10 10 Long Can Irs Collect Back Taxes Ntc Financial How To Find Out West Palm Beach Palm Beach

By law the IRS only has ten years to collect the unpaid taxes from the time of the initial tax assessment.

. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. See if you Qualify for IRS Fresh Start Request Online. After that the debt is wiped clean from its books and the IRS writes it off.

If you are unable to pay at this time 3 How long we have to collect taxes 3 How to appeal an IRS decision4. The 10-year deadline for collecting outstanding debt is measured from the day a tax liability has been finalized. After the IRS determines that additional taxes are due the.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. Take Advantage of Fresh Start Program. This is the length of time it has to pursue any tax payments that have not been made.

However if youre expecting a refund. Confirm That Youre Only Going Back Six Years Call the IRS or a tax professional can use a dedicated hotline to confirm that you only have to go back six years back for unfiled taxes. A seizure of property6 Summons.

For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. How Long Does the IRS Have to Collect Taxes. That collection period is.

Subject to some important exceptions once the ten years are up the IRS has to stop its collection efforts. The IRS doesnt have forever to collect taxes from you. This 10-year period is called the statute of limitations on collections which is also more commonly referred to as Collections Statute Expiration Date CSED.

The time to audit taxes can be. How long can the IRS collect back taxes. The IRS 10 year window to collect starts when the IRS originally determines that you owe taxes that is usually when you filed your tax return or when the result of an IRS audit.

Ad Owe back tax 10K-200K. Once taxes are assessed whether on your tax return or by the IRS in a notice theres a different time limit on IRS collections. No refunds are issued three years after the filing due date.

Although taxpayers can file up to six months later when they have an extension taxes are still owed by the original due date. However there are several things to. If you owe money you will have to pay what you owe plus interest and late filing and late payment penalties.

This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were assessed. A fairly lengthy list of actions can occur that will allow the IRS to extend that 10 year period however. You Wont Get Old Refunds The IRS doesnt pay out old refunds.

Though the chances of getting live assistance are slim the IRS says you should only call the agency directly if its been 21 days or more since you. If you have a refund due you will forfeit that refund and perhaps get stuck with a 450 or more minimum late filing penalty the amount is adjusted for inflation each year. How Long Does the IRS Have to Collect Back Taxes From Me.

Trusted A BBB Member. If the IRS does find issues with your return itll send you a notice with instructions. This means that under normal circumstances the IRS can no longer pursue collections action against you if 10 years have passed since the clock started on your tax debt.

53 minutes agoKeep in mind that the IRS may not have information on your payment until seven to 10 days have passed since you submitted your tax return. You can only claim refunds for returns filed within three years of the due date of the return. After this 10-year period or statute of limitations has expired the IRS can no longer try and collect on an IRS balance due.

Get Your Qualification Options for Free. If you dont pay on time. If you got your return done at the last minute it may be.

This can happen in a number of ways. Paying your tax debt in full is the best way to get rid of a federal tax lien. Ad File Settle Back Taxes.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. Possibly Settle Taxes up to 95 Less. As already hinted at the statute of limitations on IRS debt is 10 years.

It is not in the financial interest of the IRS to make this statute widely known. This time restriction is most commonly known as the statute of limitations. Federal Tax Lien5 Notice of Federal Tax Lien5 Levy.

The IRS has a set collection period of 10 years. As a general rule there is a ten year statute of limitations on IRS collections. If the agency finds no issues your refund could arrive within six to 12 weeks assuming no taxes are owed.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Owe IRS 10K-110K Back Taxes Check Eligibility. Used to secure information7 IRS Actions Affecting Passports7.

As a general rule according to the statute of limitations they can collect up to 10 years from the date your taxes were assessed. Understanding collection actions 4 Collection actions in detail5. Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes.

When Does the Statute of Limitations Start. The date of assessment is usually the date the tax return is due or the date the return is. There is an IRS statute of limitations on collecting taxes.

Can The Irs Take Or Hold My Refund Yes H R Block

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Pin By Kuotabro Com On Trik Kuota Internet Irs Taxes Payroll Taxes Business Tax

Tax Consolidation Irs Debt Relief Help From Licensed Professionals

Campbell Irs Tax Problems And Tax Resolution Services Telesky Financial Services

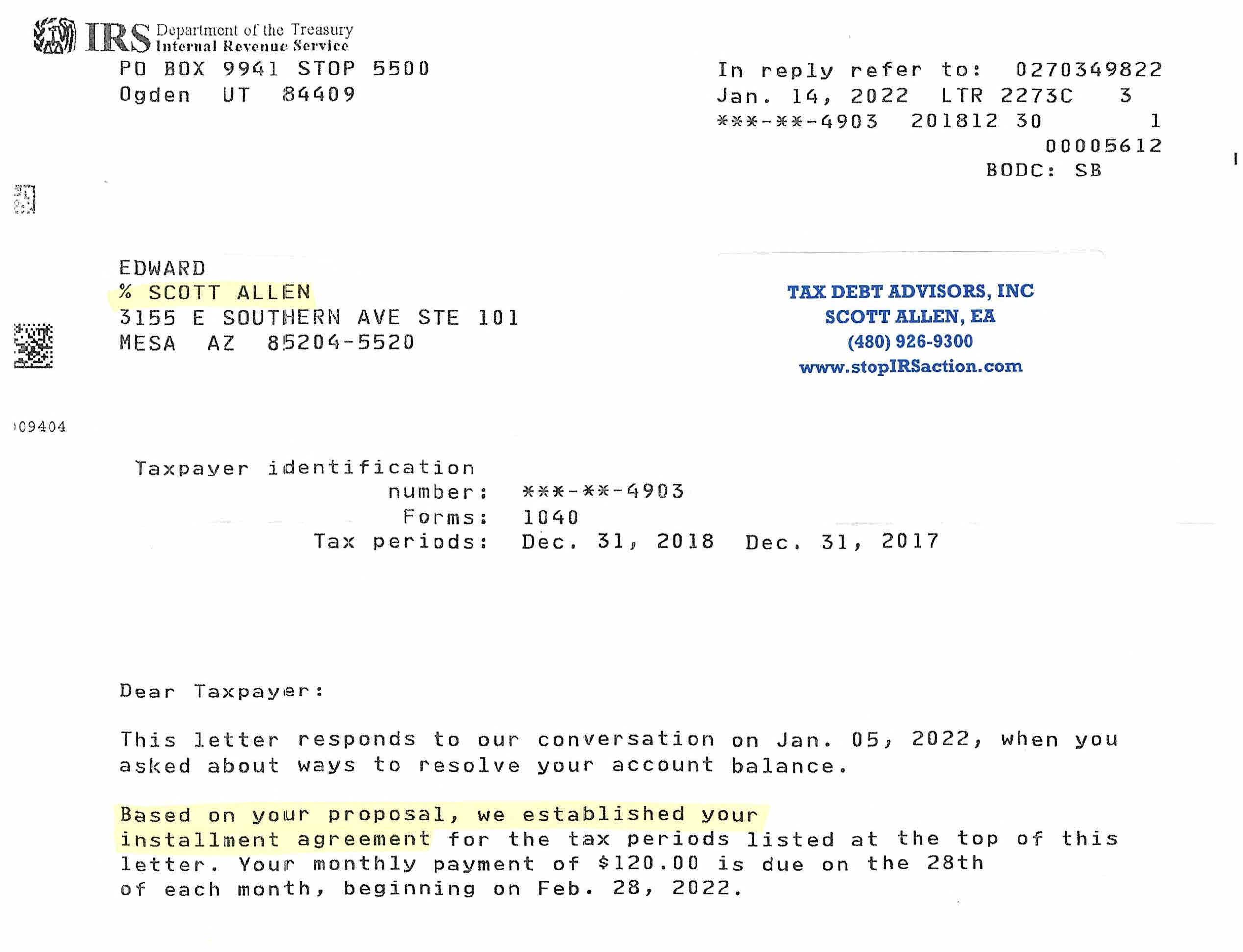

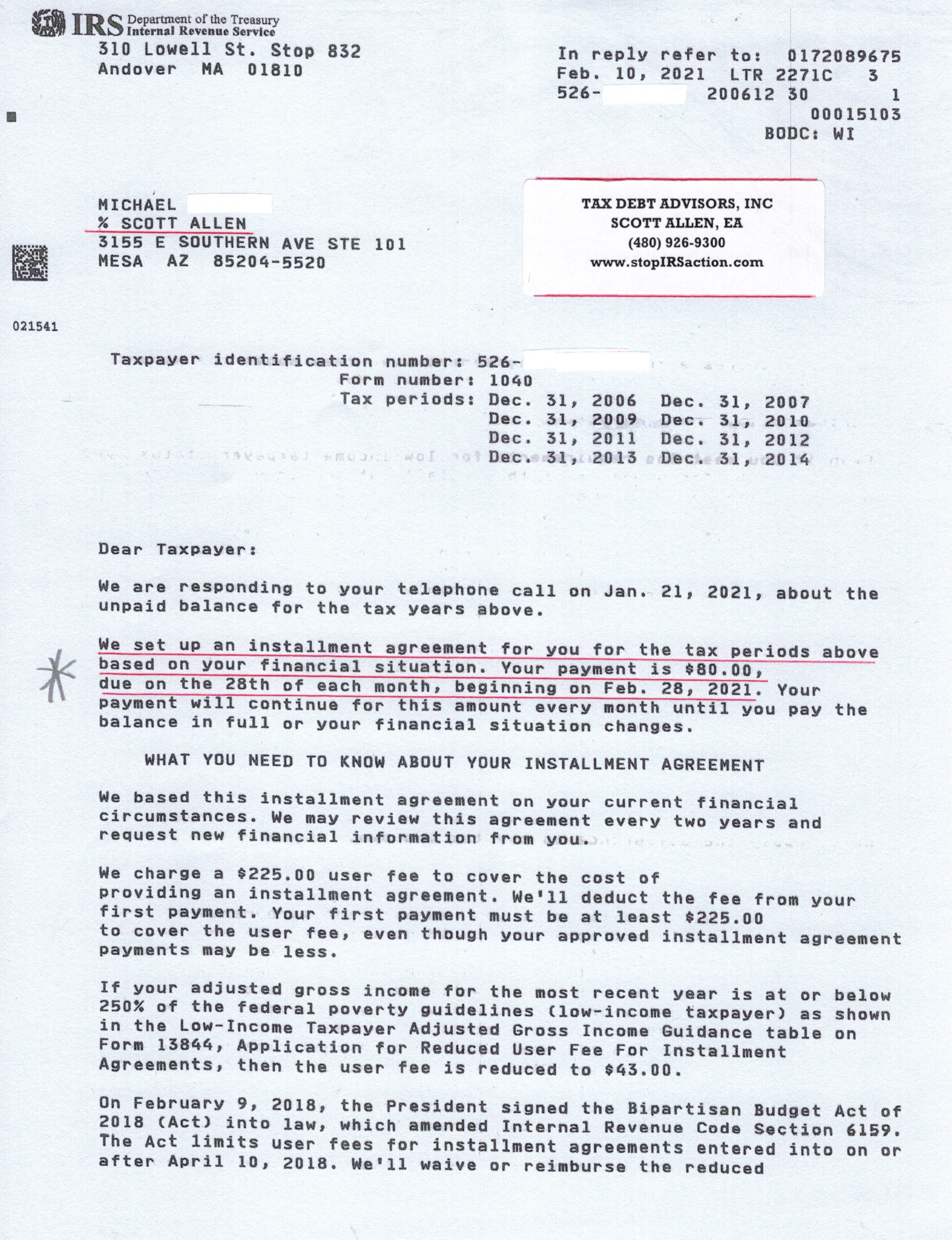

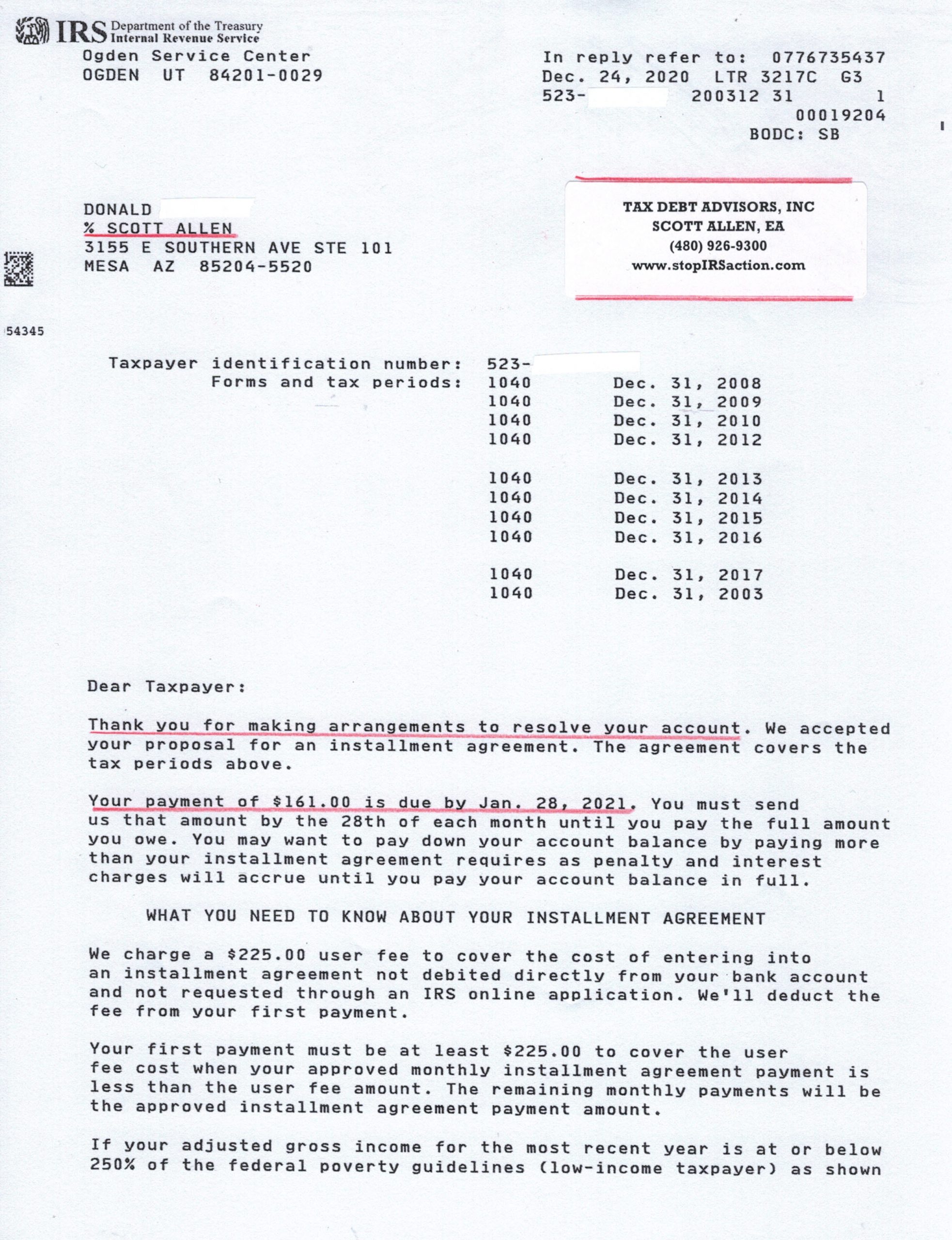

Irs Tax Payment Plan Tax Debt Advisors

Irs Hardship Currently Non Collectable Alg

Help With Irs Debt 11 Ways To Negotiate Settle Tax Debt

Irs Tax Payment Plan Tax Debt Advisors

Irs One Time Forgiveness Program Everything You Need To Know

Can I Transfer Assets To Another Person If I Owe The Irs Houston Tax Relief Attorneys

Irs Tax Payment Plan Tax Debt Advisors

The Irs Tax Debt Forgiveness Program Explained

Is It Possible To Settle My Irs Debt This Tax Season

Offer In Compromise Acceptance Letter Offer In Compromise Debt Relief Programs Tax Debt